••••

ALDINE ISD

Library

Welcome Aldine ISD Employees!

Here, you will be able to access and view your 2024 benefits plan options. These videos and resources are designed to provide you the information you need to maximize your benefits.

This video provides a high-level overview of your benefits offering for next year. Click the 2024 Benefits link for complete details and the Enroll now button to enroll today.

Medical and Rx

Mental Health Resources and EAP

Dental and Vision

Disability

Employee Perks

Life and Voluntary Life

Additional Voluntary Benefits

Benefits Video Library

Benefit Terms Explained

FSAs

Voluntary Benefits Overview

403(b) Retirement Plans

529 College Savings

Employee Assistance Programs

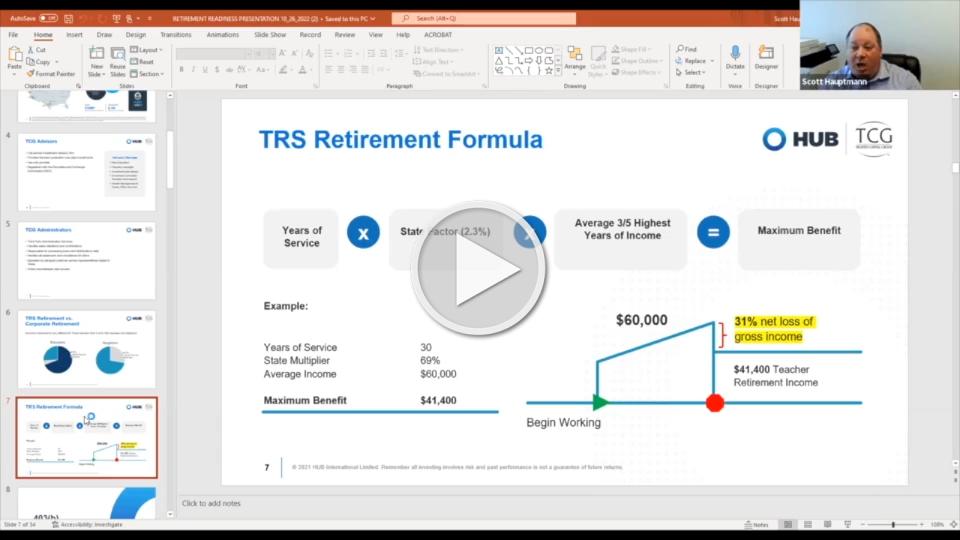

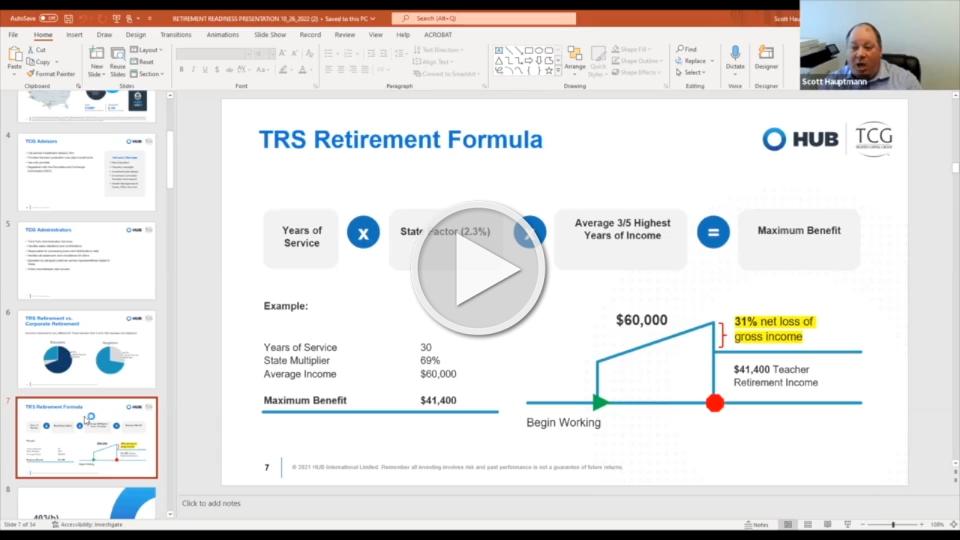

Retirement Readiness Presentation

HSA Presentation

Open Enrollment Presentation

Kelsey-Seybold Open Enrollment Presentation

Introduction to Medicare

Contact a Benefits Outlook representative at 855.474.9494